per capita tax definition

Means the sales and use tax distributions for the fiscal year beginning July 1 2013 and ending June 30 2014 to each. I am a Phoenixville resident.

Racial Disparities And The Income Tax System

Definition in the dictionary English.

. Calculating per capita entails taking into account a measurement or number amount by which you will then divide by the total population of the group wishing to be. This tax is due yearly. Do I pay this tax if I.

Per unit of population. It can apply to the average per-person income for a city region or country and is. How do I file a request for exemption from the per capitaoccupation tax.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Request for exemption from payment of the 20___ per capita tax. For most areas adult is defined as 18 years of age or older.

What is the Per Capita Tax. For most areas adult is defined as 18 years of age and older though in some. Means the total assessed value within each county for the 2014 tax year multiplied by twelve 12 mills and divided by the county.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Income per capita is a measure of the amount of money earned per person in a certain area. Define Per capita potential county sales and use tax revenue.

It is not dependent upon employment. Net tax per capita means the adjusted net tax capacity of all taxable real property in the city or town or county divided by the total population of that city town or. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Per capita GDP is a measure of the total output of a country that takes gross domestic product GDP and divides it by the number of people in the country. Per capita tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will.

By or for each individual a high per capita tax burden. As of the amount for each municipality concerned is assessed in proportion to. For most areas adult is defined as 18 years of age and older.

The measurement of a countrys per capita income is done by dividing the total national income of a particular country or state by the population in that specific geographical region. Match all exact any words. I am new to the area can I get added the tax rolls.

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Define Per capita potential county ad valorem tax revenue. It means to share and share alike according to the number of.

:max_bytes(150000):strip_icc()/income-per-capita-4194771-FINAL-20db6a0179cf49989cfe81a17007192e.png)

What Is Income Per Capita Uses Limitations And Examples

Sugar Sweetened Beverage Taxes Lessons To Date And The Future Of Taxation Plos Medicine

Per Capita Tax Burden Is Misleading Public Assets Institute

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

Gross National Income Gni Definition Formula Examples Uses

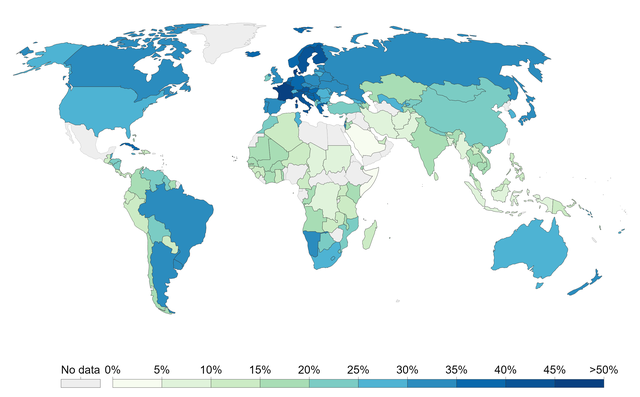

How High Are State And Local Tax Collections In Your State

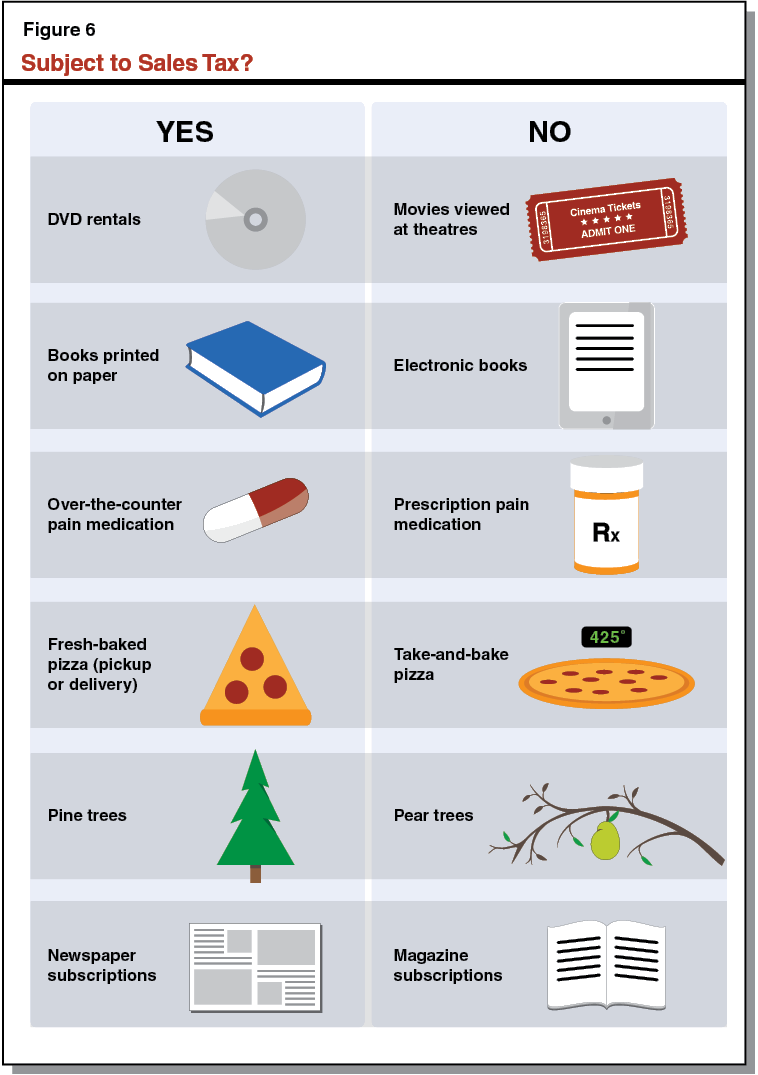

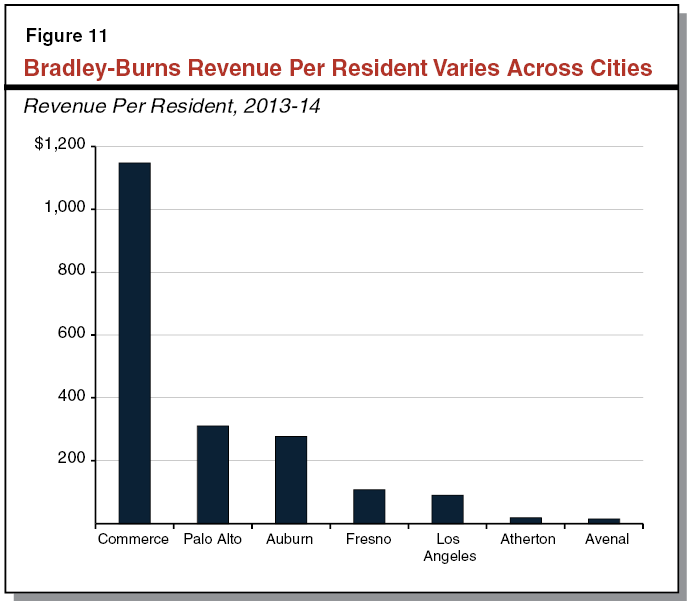

Understanding California S Sales Tax

Understanding California S Sales Tax

Tax Policy Center On Twitter Ohio Is Less Reliant On Property Taxes Than Neighboring States But Gets A Higher Percentage Of Its Revenue From Federal Transfers See How Each State S Tax System

Understanding California S Sales Tax

What Does Pcotr Mean Definition Of Pcotr Pcotr Stands For Per Capita Own Tax Revenue By Acronymsandslang Com

Creating Racially And Economically Equitable Tax Policy In The South Itep

Romania Commercial Tax Rate Data Chart Theglobaleconomy Com

The Macroeconomics Of The Greek Depression Bfi

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

What Are State Income Taxes Turbotax Tax Tips Videos

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

:max_bytes(150000):strip_icc()/gdp-per-capita-formula-u-s-compared-to-highest-and-lowest-3305848-v2-5b71efd746e0fb004f595b3e.png)